Healthcare Revenue Cycle Management

Healthcare Revenue Cycle Management

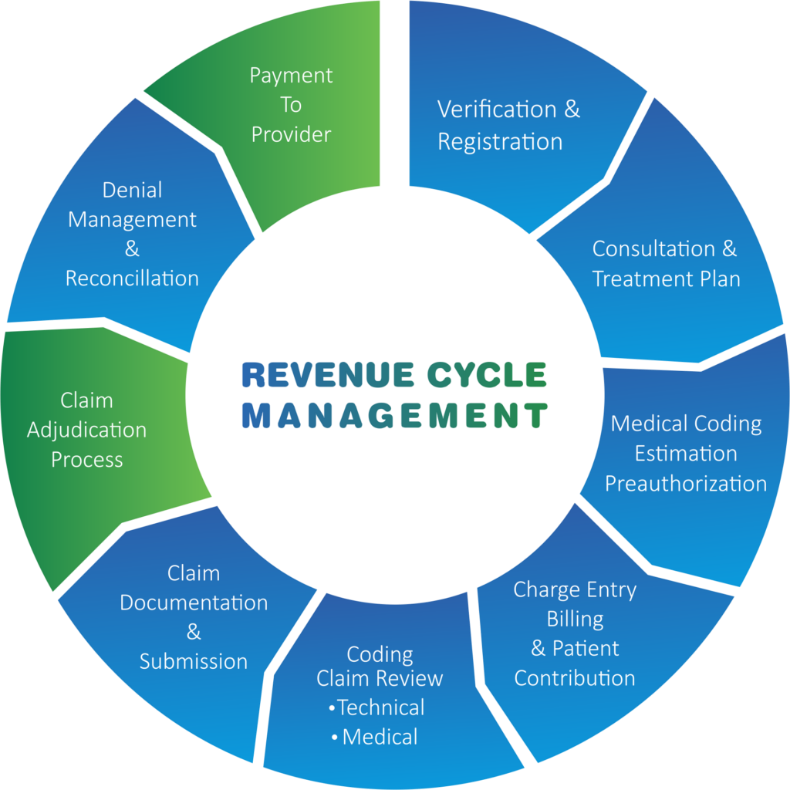

From insurance pre-authorization to claims processing and collections, we provide end-to-end RCM support for healthcare organizations.

Healthcare Revenue Cycle Management Solutions: Helping You Focus on Patients, Not Payments

Strategic revenue cycle management (RCM) is the lifeblood of any healthcare organization, alleviating bottom-line pressures and securing proper reimbursement for services rendered.

But mounting pressures beyond healthcare enterprises’ control—including critical staff shortages, inflation, and rising healthcare costs—have nearly half of U.S. hospitals grappling with negative margins, according to a recent Everest Group report.

Labor shortages are impacting revenue collection as well, with nearly 1 in 4 healthcare finance leaders needing to hire 20+ more employees to fully staff their departments, according to a Healthcare Financial Management Association pulse survey. Cybercriminals are also zeroing in on the virtual goldmine of data that health systems possess, making healthcare the third-most targeted industry in 2024.

Promantis Revenue Cycle Management Outsourcing solutions can help.

Leading healthcare providers rely on Promantis to maintain their own wellness and reduce costs: streamlining operations, accelerating cash flow, reducing days outstanding, supporting revenue integrity, and mitigating high turnover and hiring challenges.

With service delivery from the top nearshore hubs in Latin America; cutting-edge implementation of technologies including automation, AI, machine learning, and analytics; and more than 25 years of experience optimizing business operations, we can significantly lower your spending without impacting the quality of your patient care – or your back office.

Recent reports credit the rise of nearshore outsourcing with the recent explosive growth of the healthcare business process outsourcing (BPO) market. Outsourcing revenue cycle management to Promantis’ service delivery center provides instant access to innovation and agility in your time zone.

Our highly educated resources offer the critical-thinking skills and real-time collaboration needed to support the complexities of time-sensitive, judgment-intensive RCM processes. The outstanding English proficiency and cultural alignment of our nearshore locations drives easy communication as well, negating potential difficulties surrounding complex healthcare terminology.

We also have deep experience helping clients navigate the complexities of healthcare regulations like HIPAA, maintaining stringent compliance frameworks that ensure security, data privacy, and adherence to billing and coding guidelines. And our strong recruiting, onboarding, and retention practices keep our attrition below industry average – driving consistent performance.

Modern challenges confronting healthcare organizations require new solutions. Partnering with Promantis’ healthcare revenue cycle management services maximizes performance of your RCM operations – freeing you from revenue concerns so patient care can take center stage.

Note: As labor shortages and financial challenges persist, 61% of healthcare providers plan to outsource revenue cycle management activities.

Our Revenue Cycle Management Solutions:

By outsourcing revenue cycle management to Promantis, you gain instant access to best practices and the latest technology for revenue cycle optimization: reducing administrative burdens and errors, improving cash flow, speeding turnaround times, and driving organizational success. Our end-to-end RCM solutions include:

- Insurance Verification: Confirming insurance coverage for patients, including dual eligibility, Type Program (TP) eligibility, and out-of-state verification.

- Insurance Prior Authorization: Determining and submitting insurance authorizations and following up through completion. Benefits Determination: Identifying in- and out-of-network benefits and patient liabilities.

- Coding: Turning a visit summary into an insurance or billing document by ensuring health information and services are coded properly, efficiently, and in full compliance.

- Claims Processing: Properly formatting and submitting claims to insurance providers. Includes complex claims for non-traditional payers like workers’ compensation and motor vehicle accidents.

- Claims Follow-ups: Checking claims status as well as reasons for non-response, delayed payments, and improper claim denials.

- Claims Denial Resolution: Reviewing claim denials to identify and correct errors and manage the appeals process.

- Accounting Transactions: Payment processing, payment application, account reconciliation, and resolution of credits and refunds.

- Billing & Collections: Following provider policies and procedures for charging patient accounts and collecting payments.